Free 50/30/20 Budgeting Template for Notion

Transform Your Finances with the 50/30/20 Budgeting Rule Notion Template

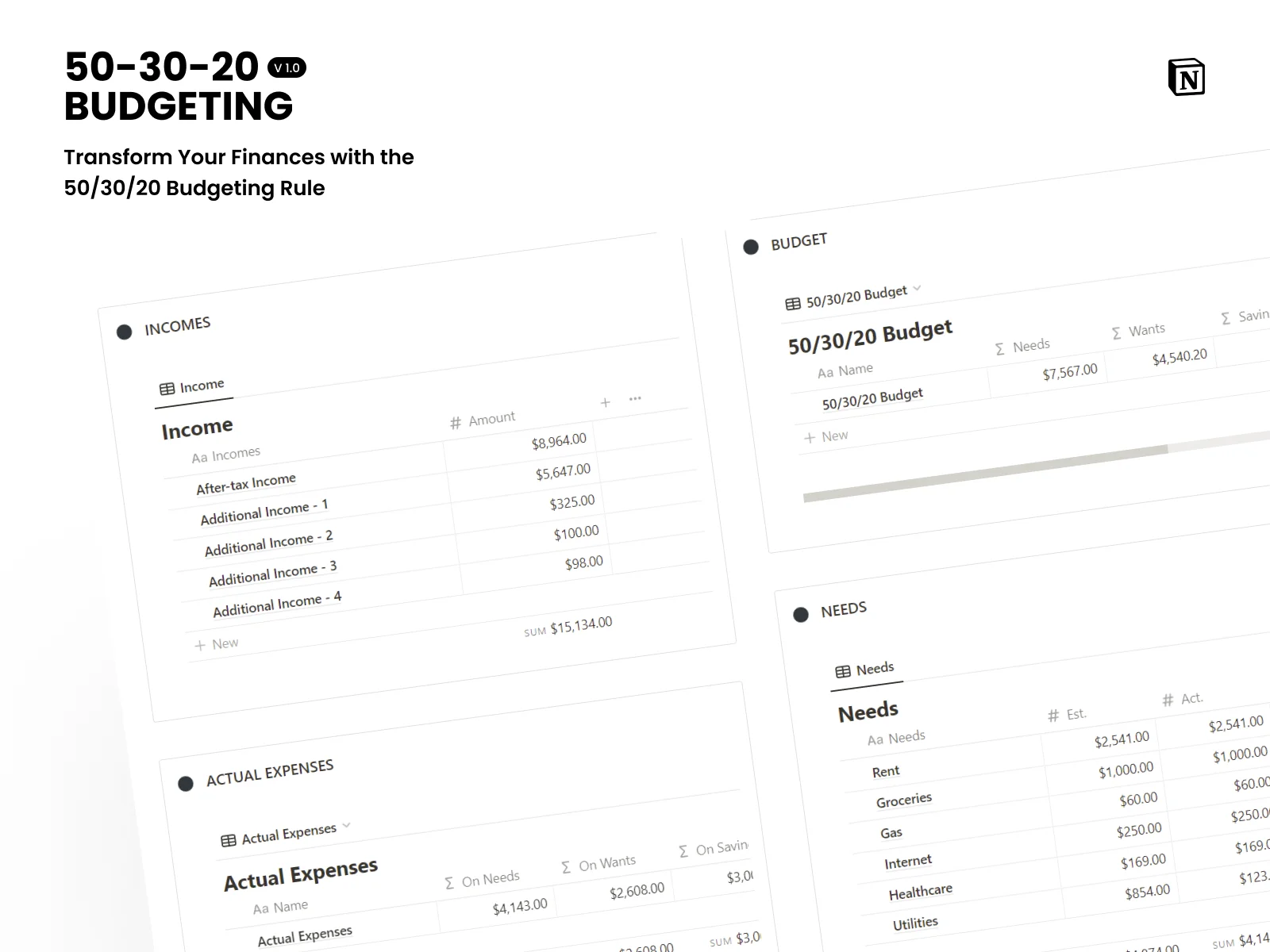

Take Control with the Free 50/30/20 Budgeting Template

Do you find yourself tired of financial stress, struggling to take control of your money? Have you ever wished for a tool that could simplify your finances and empower you to make smarter financial choices? Your solution is here – our Free 50/30/20 Budgeting Template for Notion is designed to transform your financial habits and lead you toward financial freedom.

What's Inside the 50/30/20 Budgeting Template?

Unlock the simplicity of the 50/30/20 rule:

This template helps you allocate your after-tax income effectively, dividing it into necessities, discretionary spending, and savings or debt payments.

Visualize Your Budget

Clearly see how much of your income goes into needs, wants, and savings, helping you make informed financial decisions.

Who Came Up With the 50/30/20 Budgeting Rule?

Created by Elizabeth Warren, an insolvency expert at Harvard University, and her daughter Amelia, the 50/30/20 rule is a simple yet powerful method accessible to everyone. No complex budgeting skills or economic background required – just a desire to take control of your finances.

How to Budget With the 50/30/20 Rule

Budgeting is made simple with the 50/30/20 rule, guiding you to allocate your after-tax income effectively. Spend 50% on needs, 30% on wants, and stash 20% for savings.

Frequently asked questions

Understanding where your money goes empowers you to make intentional financial decisions, leading to greater control and security.

Budgeting ensures that your money is allocated strategically, accelerating your progress toward savings and other financial objectives.

The 50/30/20 rule simplifies budgeting by breaking down your income into three clear categories, making it easy to allocate funds for necessities, wants, and savings.

The template is flexible and can be adapted to any income level, providing a framework that suits various financial situations.

Notion enhances budgeting by offering a customizable and collaborative platform, allowing you to tailor your financial management to your unique needs.

The 50/30/20 rule ensures you allocate a portion of your budget for non-essential expenses, allowing you to enjoy life while still saving.

Distinguishing between needs and wants helps you prioritize essential expenses, ensuring financial stability, while still allowing room for discretionary spending.

By allocating 20% of your income to savings, the 50/30/20 rule creates a financial cushion, offering security and preparedness for unforeseen circumstances.

The template provides insights into your spending patterns, making it easier to identify areas where adjustments can be made for better financial management.

The 50/30/20 rule is simple, effective, and provides a balanced approach to budgeting, making it accessible and adaptable for individuals seeking financial success.