Trade without the knot in your stomach

Built by a trader for traders

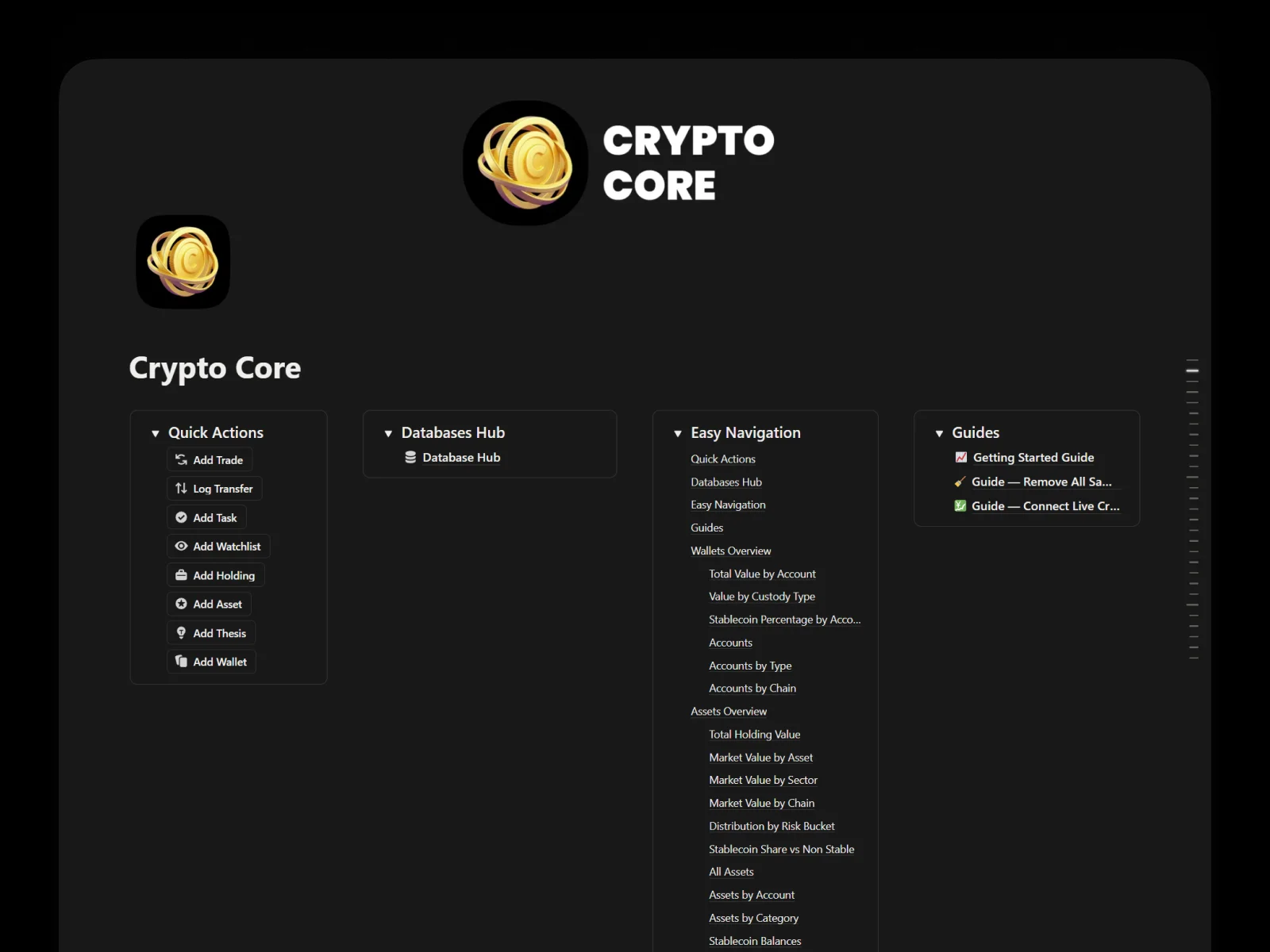

1+ solid dashboards

9+ databases wired together

You’re not bad at trading. Your system is.

You don’t need more dashboards.

You need a loop that makes the right behavior the easiest behavior.

Juggling wallets and spreadsheets yet blind to true exposure

Diversified until one coin nukes your month

Entries on vibes, exits on fear

Watchlist is a graveyard of great ideas seen too late

Transfers and fees are a tax‑season nightmare

Theses go stale because reviews don’t happen

No journal → same mistakes keep winning

What Crypto Core does

See clearly. Decide calmly. Execute consistently.

See clearly

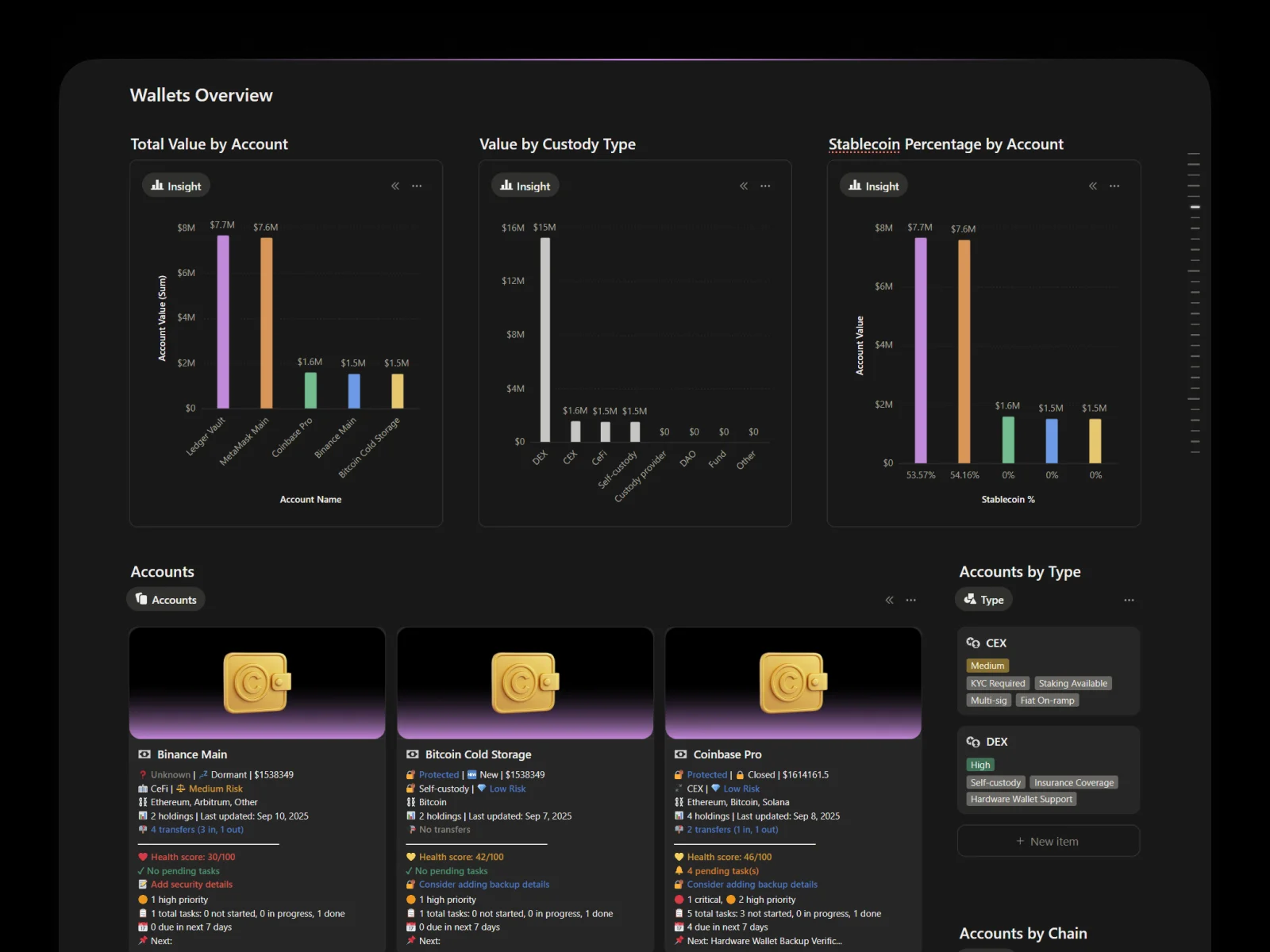

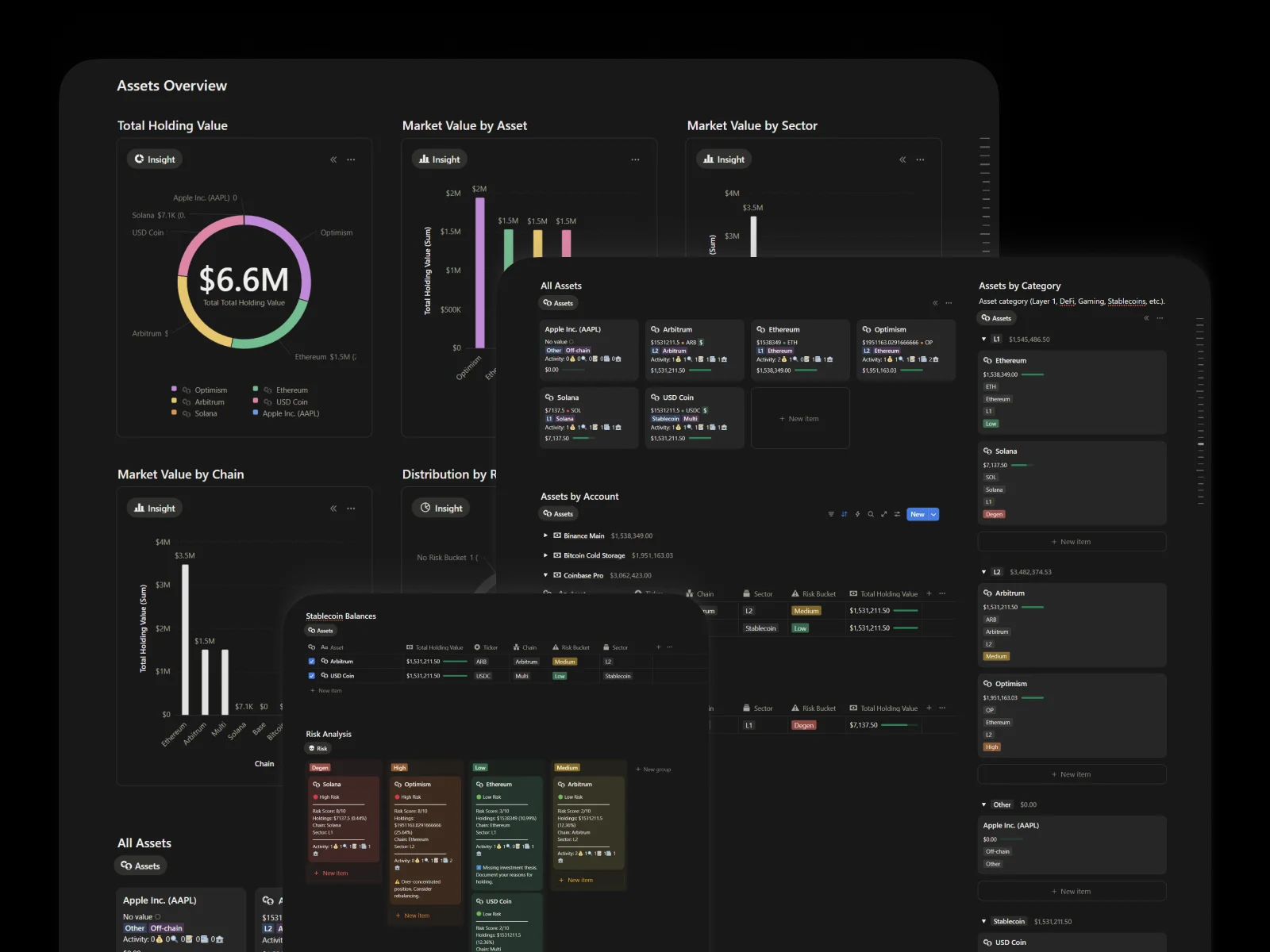

Real exposure by account, chain, sector, risk, and stables

Decide calmly

Theses with conviction, invalidations, catalysts, and cadences

Execute consistently

Tasks, watchlist, journal, and PnL loops

What's Inside

Main Dashboard

A single command center with exposure by account and chain, PnL today and MTD, reviews due, this week’s tasks, high‑urgency signals, and recent transfers. Scan, decide, act.

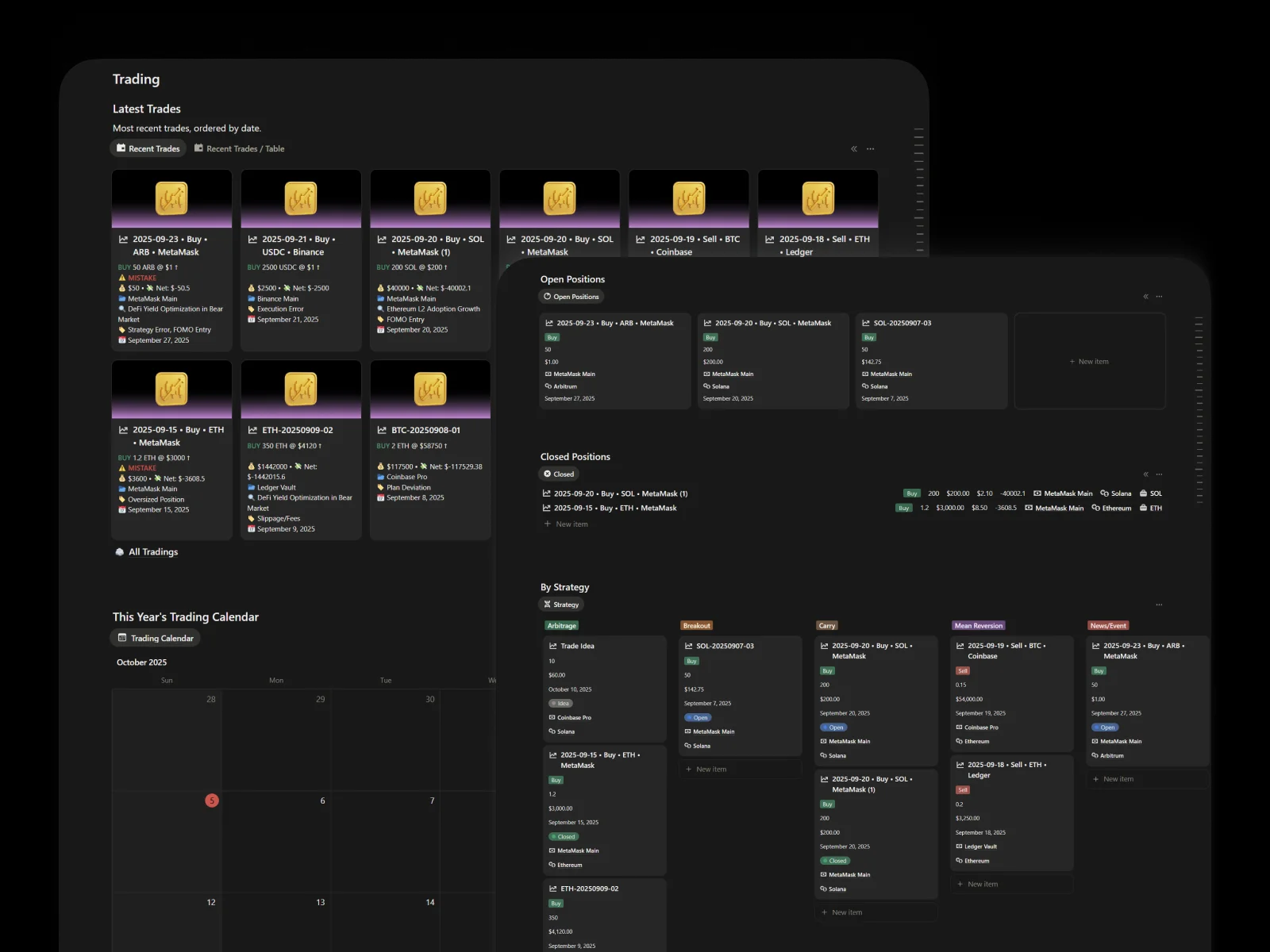

Trading

Log latest trades, open and closed positions, and break them down by strategy and timeframe. Review PnL summaries, chart performance, capture mistakes and lessons, and keep a backlog of trade ideas.

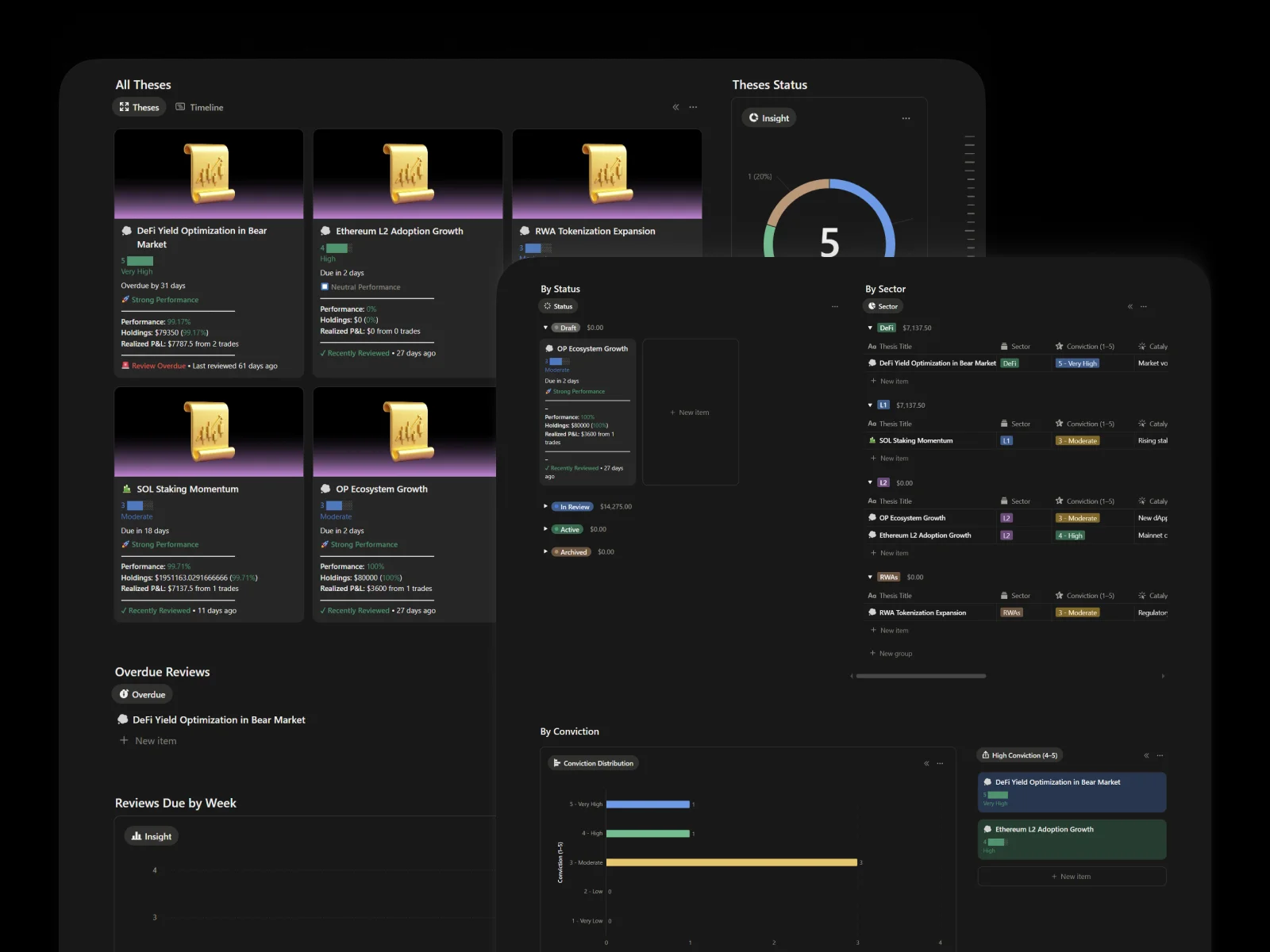

Research

Manage theses by status, sector, and conviction. Keep reviews on cadence and link research notes and references so decisions stay traceable.

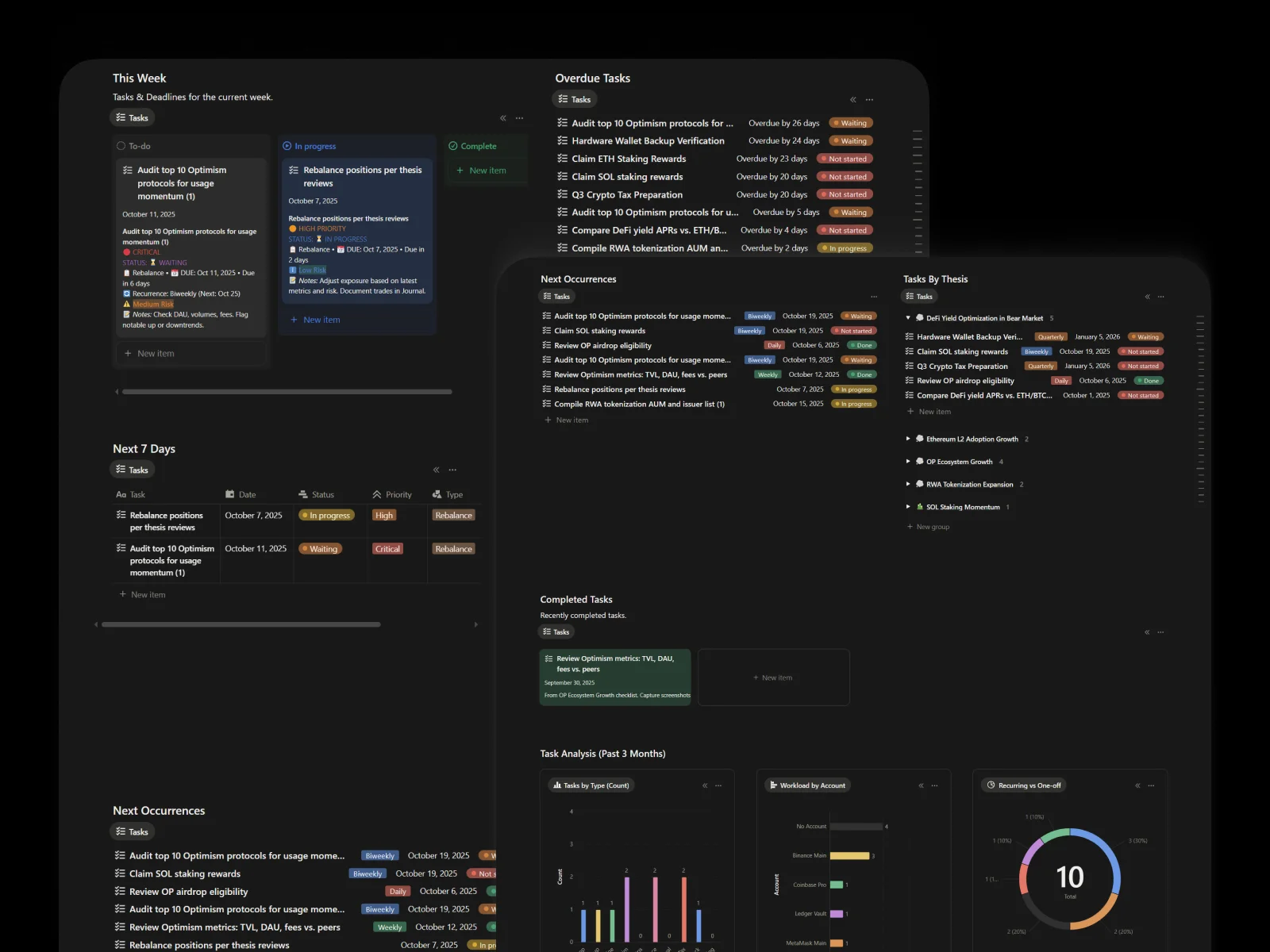

Tasks & Deadlines

Work from one list: this week, next 7 days, and overdue. Tie tasks to theses or positions and watch 3‑month throughput trends.

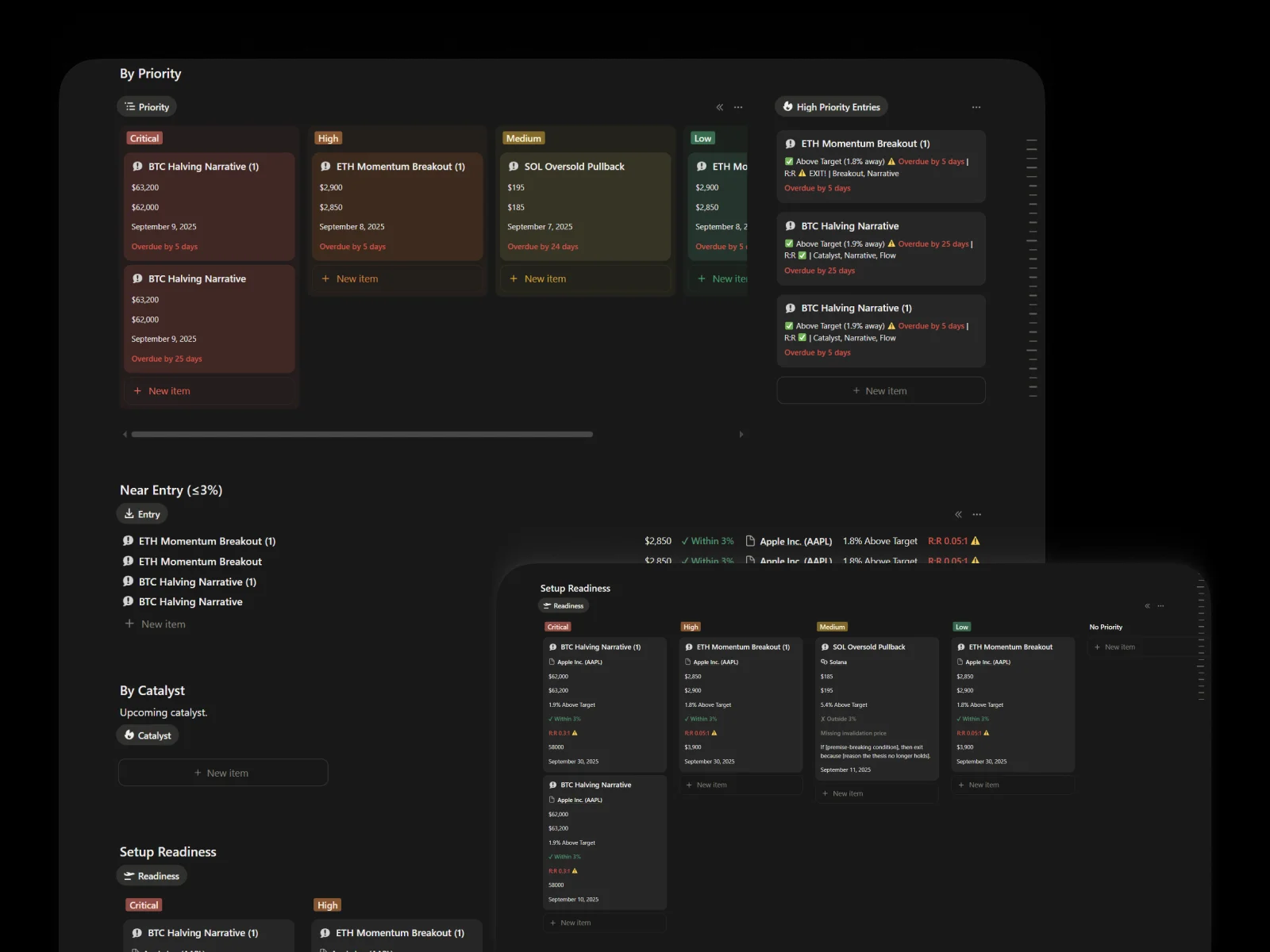

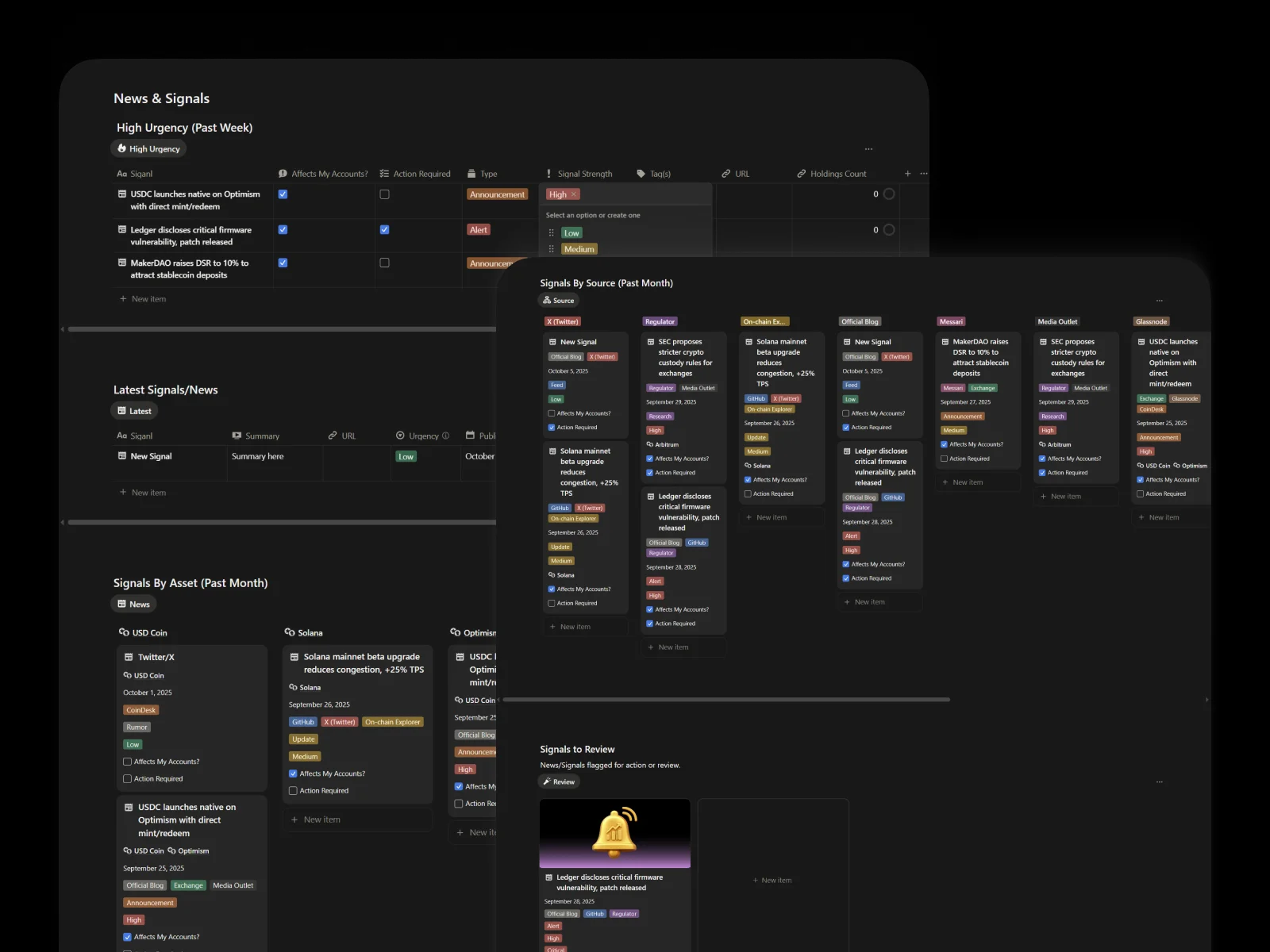

News & Signals

Filter noise to signal with a high‑urgency feed, views by asset and by source, and a tidy review queue for action.

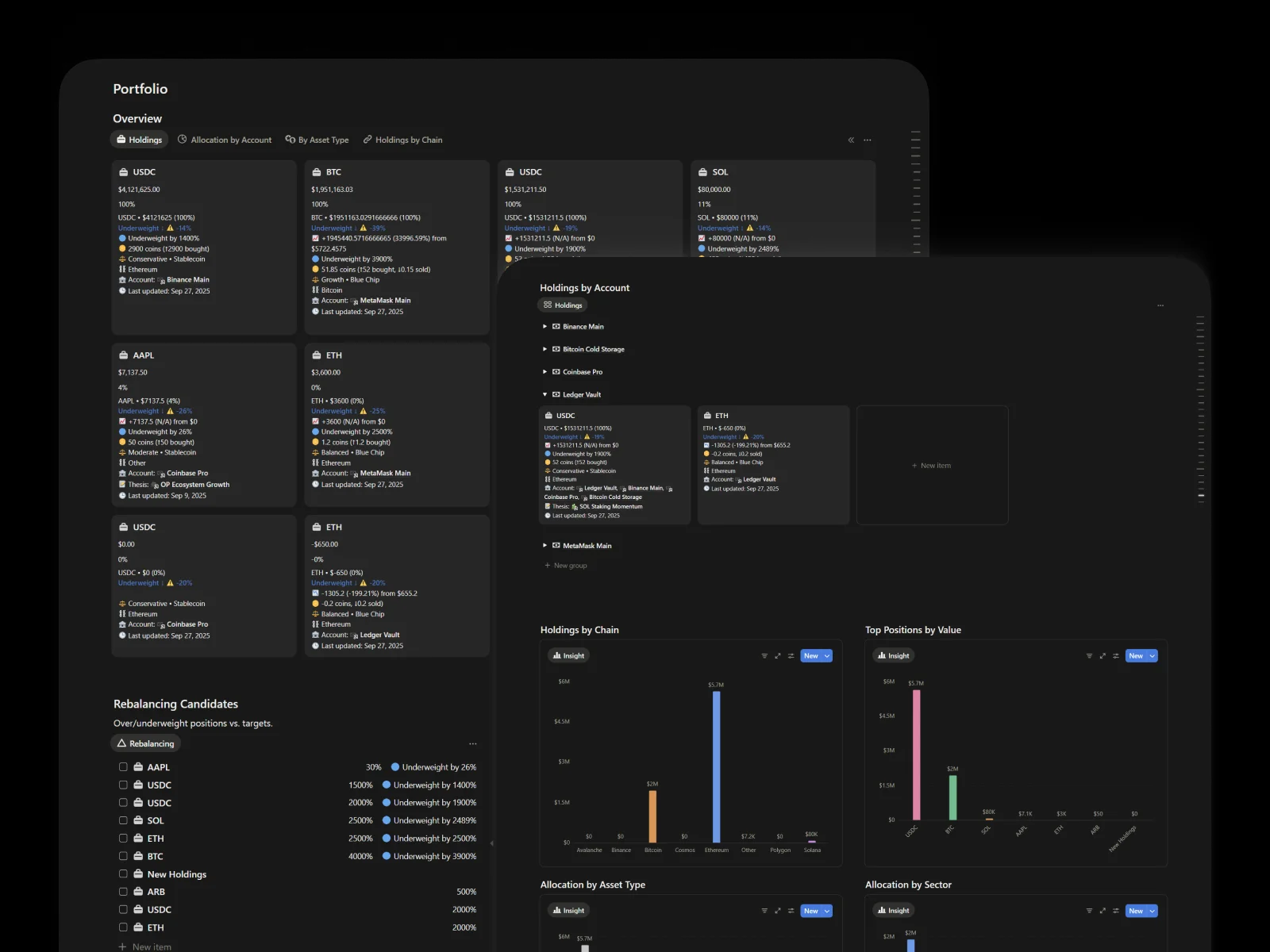

Build the portfolio you can manage

Solo

For personal use only

$179

- Full Version of Crypto Core

- Lifetime Access & Updates

- Outstanding Support

- Step by Step Guide

One-time payment

Notion Complete Bundle

$1,428

$249

All the premade Notion dashboard templates you need + Crypto Core to enhance your life and business, in one powerful bundle! ⚡

Here’s What Others Have to Say

We’ve got so many awesome testimonials that you’d need more than a day to go through them all. But hey, here are a handful of random ones from our incredible Notion-loving customers.

Before You Ask

No. The system is designed to remove decisions, not add them. Each dashboard answers one question. If it doesn’t drive a decision, it’s not in the top view.

You’ll catch the mistake in the Journal, label it in Lessons, and add a better rule. Seeing the same mistake twice next week is painful enough that you’ll stop. That’s the point.

You likely don’t see concentration or stable share in one place. The Wallets and Assets Overviews make risk and stables visible. You rebalance because the system shows you, not because the market scares you.

Theses are wired to tasks and watchlist. Research without a next action is archived or scheduled for a review. The system pushes you toward decisions.

Define “good enough to act” in your thesis criteria. If it’s met, take the trade. If not, you aren’t missing out. You’re staying consistent.

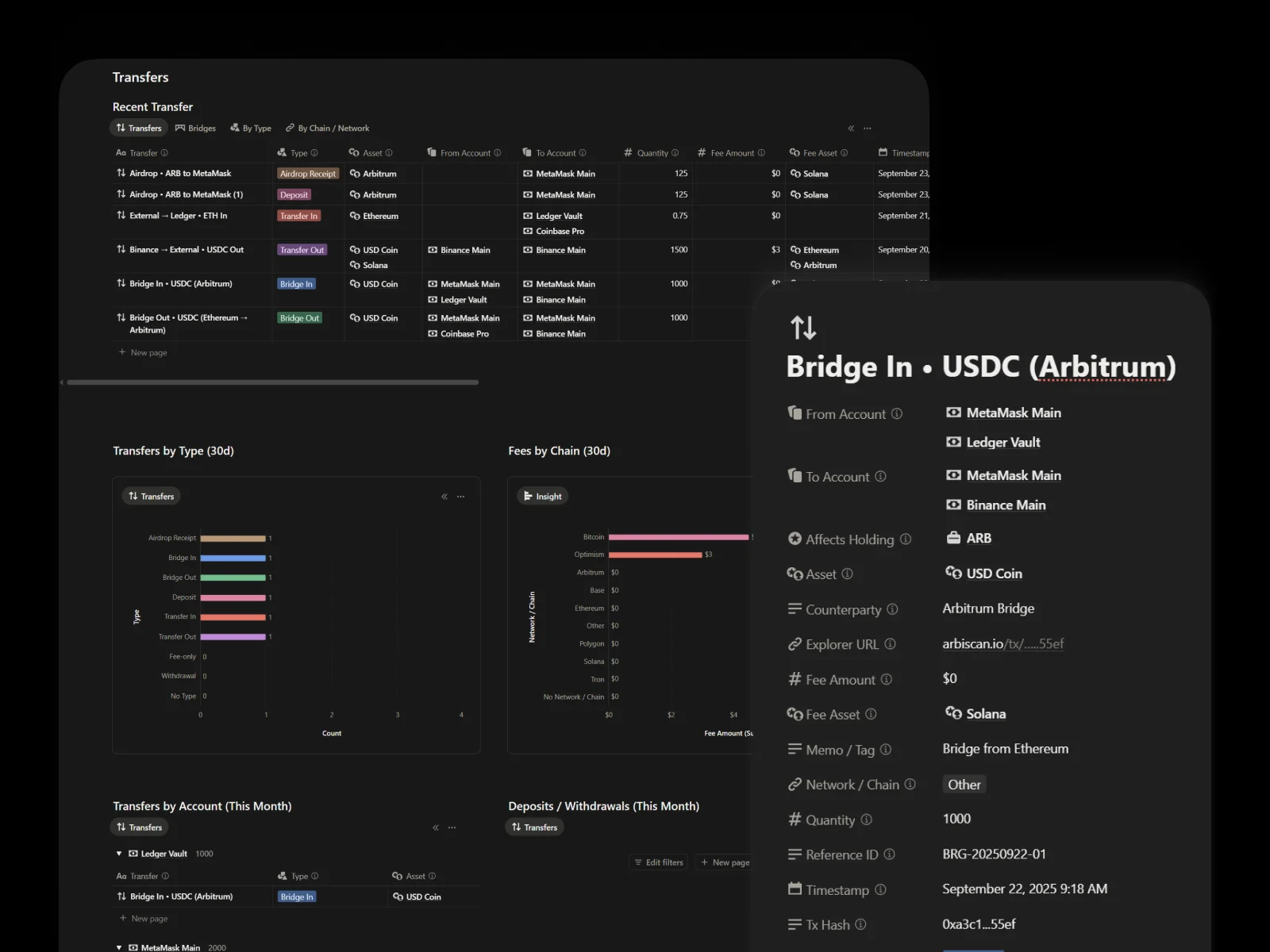

Transfers, fees by chain, and monthly flows are organized. It won’t file taxes. It will keep your records sane.

3 steps.

- Check exposure: Wallets and Assets Overviews. Make sure stablecoin share and risk buckets are inside your guardrails.

- Pick actions: Open Watchlist → filter “Near Entry” and “Catalyst Soon.” Link to a thesis. Create 1–3 tasks.

- Close loops: Journal any trades. If something stung, add one Lesson.

Do this once a week. Ten minutes mid-week if needed.

Use this skeleton:

- Belief: What you think and why it could be true

- Catalysts: What might make it true sooner

- Invalidation: What would prove you wrong

- Cadence: When you’ll review

Add a conviction score. If invalidation hits, you’re out. No drama.

Tie every potential entry to a thesis before you click buy. In Watchlist, link the setup to its thesis and write entry criteria. If the criteria aren’t met, pass. Passing is a decision.

Use four tiles.

- Rebalancing Candidates

- Overdue Thesis Reviews

- PnL Summary (last week)

- Mistakes & Lessons

Make one decision per tile. You’re done.

Log Trade → Asset, Account, Size, Strategy, Timeframe, Thesis. If loss > X% or rule broken, check “Add Lesson” and write the better rule.

Add Accounts. Add Assets. Create Holdings with quantity and cost basis. If you have a CSV, paste in batches (Accounts, then Assets, then Holdings). You can skip backfilling old trades and start fresh from today.

You don’t need them. If you want them, use the included guide to connect price feeds. Start simple first.

Open This Week (Tasks), Near Entry (Watchlist), and Overdue Reviews (Theses). If nothing qualifies, do nothing. Inaction is a position.